International trade is a factor and a product of the economic development of nations. Similarly, the evolution of the trade theory reflects the ways nations were addressing basic economic problems. During the period from the sixteenth to the middle eighteenth century Britain, Spain, France, and Netherlands were the most developed countries with a high level of government intervention in the economy.

Their governments were concerned with the ways of maintaining their own power and wealth. The economic philosophy that properly reflected these goals was known as mercantilism.

Mercantilism was the main economic system of trade utilized from the 16th to 18th century. Mercantilist theorists believed that the amount of wealth in the world was static. Thus, European nations took several strides to ensure their nations accumulated as much of this wealth as possible. The goal was to increase a nation's wealth by imposing government regulation that oversaw all of the nation's commercial interests. It was believed national strength could be maximized by limiting imports via tariffs and maximizing exports

Mercantilism was popularized in Europe during the 1500s. The system was based on the understanding that a nation's wealth and power were best served by increasing exports and collecting precious metals, such as gold and silver. Mercantilism replaced the older, feudal economic system in Western Europe, leading to one of the first occurrences of political oversight and control over an economy. At the time, England, the centre of the British Empire, was small and contained relatively few natural resources. Thus, to grow its wealth, England introduced fiscal policies, including the Sugar Act and Navigation Acts, to move colonists away from foreign products and create another incentive for buying British goods. The resulting favourable balance of trade was thought to increase national wealth.

The Sugar Act of 1764 introduced high customs for sugar and molasses imported from outside of England and the British colonies. Similarly, the Navigation Act of 1651 was implemented to ensure foreign vessels would not be able to engage in trade along its coast, and also required colonial exports to first pass through British control before being redistributed throughout Europe. Great Britain was not alone in this line of thinking. The French, Spanish and Portuguese competed with the British for wealth and colonies; it was thought no great nation could exist and be self-sufficient without colonial resources (Investopedia, 2018).

Mercantilists argued that the best way for a nation to enjoy faster growth was to export more than it imported. The revenue would be a real inflow of gold. Since the amount of gold was fixed in the short run, not all nations could have such inflows simultaneously and gains from trade might be enjoyed only at the expense of the other nations. That is why mercantilist advocated import restrictions and export promotion.

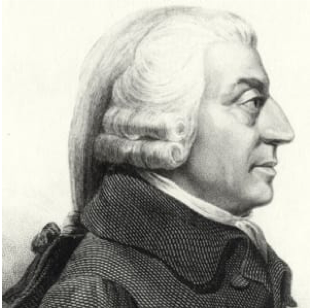

Mercantilists’ views were challenged by Adam Smith who advocated free trade based on absolute advantages of nations. He proved that the advantages of international division of labour and specialisation would be shared by all nations who may benefit simultaneously from free international trade. Thus, when nations specialise in industries where they have absolute factor advantages, gains from trade come to every nation and not at the expense of others and there is no need for government intervention that only deteriorates allocation of resources and productivity. This is the most important contribution of Adam Smith to international trade theory and policies. What he did not explain, was the case when a nation had absolute advantages in the production of all goods (Absolute, 2009).

Scottish social philosopher and political economist Adam Smith wrote The Wealth of Nations and achieved the first comprehensive system of political economy. Adam Smith was an economist and philosopher who wrote what is considered the "bible of capitalism," The Wealth of Nations, in which he details the first system of political economy.

Scottish social philosopher and political economist Adam Smith wrote The Wealth of Nations and achieved the first comprehensive system of political economy. Adam Smith was an economist and philosopher who wrote what is considered the "bible of capitalism," The Wealth of Nations, in which he details the first system of political economy.

Smith’s ideas are a reflection on economics in light of the beginning of the Industrial Revolution, and he states that free-market economies (i.e., capitalist ones) are the most productive and beneficial to their societies. He goes on to argue for an economic system based on individual self-interest led by an “invisible hand,” which would achieve the greatest good for all.

In time, The Wealth of Nations won Smith a far-reaching reputation, and the work, considered a foundational work of classical economics, is one of the most influential books ever written (Biography, 2018).

Smith views’ weakness was overcome by David Ricardo who developed the theory of comparative advantagesto prove that mutually beneficial trade could occur even when one nation was absolutely more efficient in the production of all goods. According to Ricardo, nations specialise in industries where they have lower opportunity cost and trade based on these comparative advantages all the countries enjoy gains from international trade. This is one of the most important and still unchallenged principles of economic theory and practice. David Ricardo’s views were based on the labour theory of value that stresses on the role of labour in value creation. Ricardo did not analyse the effect of resource endowments on productivity and international specialisation and the influence of trade on the distribution of income.

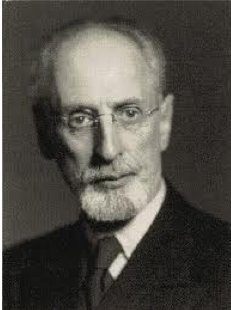

In the 1930s two Swedish economists Eli Heckscher and Bertil Ohlin developed a model of factor endowment to study these issues. They asserted that international trade is based on differences in factor endowments of nations. Because of the different endowments of factors of production nations have comparative advantages in different industries and their relative price levels differ. That is why each nation will export the goods intensive in its relatively abundant and cheap factor and import the goods intensive in its relatively scarce and expensive factor. Thus, all nations will enjoy gains from trade simultaneously.

Eli Filip Heckscher (November 24, 1879 – December 23, 1952) was a Swedish political economist and economic historian. He wrote a classic book on mercantilism, as well as several contributions to economic theory. In a famous article of 1919, he argued for free trade, putting forward the hypothesis that the comparative trading advantage of different countries is due to differences in productive factors. Eli Heckscher was born on November 24, 1879. According to a bibliography published in 1950, Heckscher had as of the previous year published 1148 books and articles, among which may be mentioned his study of Mercantilism, translated into several languages, and a monumental economic history of Sweden in several volumes. As Heckscher died on November 26, 1952, in Stockholm, he could not be given a posthumous Nobel Prize for his work on the Heckscher-Ohlin Theory (Policonomics, 2018).

Bertil Ohlin, in full Bertil Gotthard Ohlin, (born April 23, 1899, Klippan, Sweden – died August 3, 1979, Vålädalen), Swedish economist and political leader who is known as the founder of the modern theory of the dynamics of trade. In 1977 he shared the Nobel Prize for Economics with James Meade. Ohlin studied at the University of Lund and at Stockholm University under Eli Heckscher. He developed an early interest in international trade and presented a thesis on trade theory in 1922. Ohlin studied for a period at both the University of Oxford and Harvard University; at the latter institution he was influenced by Frank Taussig and John H. Williams. He obtained his doctorate from Stockholm University in 1924 and the following year became a professor at the University of Copenhagen. In 1930 he succeeded Heckscher at Stockholm University. At this time Ohlin became engaged in a controversy with John Maynard Keynes, contradicting the latter’s view that Germany could not pay war reparations. Ohlin saw reparations as nothing more than large international transfers of buying power. By 1936 Keynes had come around to Ohlin’s earlier view. Their debate over reparations contributed to modern theories of unilateral international payments (The Editors, 2018).

After the World War II, Heckscher-Ohlin theory was challenged by the evolution of international trade that it could not explain. Significant flows of intra-industry trade based on product differentiation, exports of goods intensive in nations relatively scarce and expensive factors (the so-called Leontief paradox), trade based on economies of scale, trade based on technological gaps and product cycles needed a new explanation. These issues were addresses by different theories. For example, Raymond Vernon developed the theory of international product life cycle to explain trade based on technological gaps. He asserts that the initial production of a new product usually requires skilled labour, which can be replaced by a skilled labour once the product acquires mass acceptance and is standardised. Thus, the comparative advantage held by the industrialised nations that introduce new products shifts to lower-wage nations. Vernon’s contribution to the theory of internationalisation of business is that he put together explanations of international trade and investment flows that were following trade. Later this theory was extended to explain internationalisation of industries in the international industry life cycle model.

Stefan Linder gave an explanation of interindustry trade in his theory of overlapping demand, asserting that international trade in manufactured goods will be greater between nations with similar levels of per capita income than between those with dissimilar per capital income level.

A coherent explanation of modern international trade was given by Michael Porter who developed the theory of competitive advantages of nations. He argues that competitiveness and hence international trade is determined by four factors encapsulated in the Porter Diamond. These are Factor Conditions, Demand Conditions, the Structure of Firms and Rivalry and lastly the strength and existence of Related Firms and Supporting Industries. Hence, industry clusters appear that create and enhance competitiveness of local firms. An important contribution of Porter’s theory is that he associates competitive advantages of nations with firm’s decision making. These are really firms, that conduct international trade, not countries.

In the 1990s, Alan Rugman’s approach has extended the concept of Porter’s “single” diamond in order to explain the evidence for further globalization revealed by some recent surveys, that the more international a firm was, the more it derived its competitive advantages from its foreign affiliates. This theory reflects the prevalence of trade-related investment and investment-related trade flows and it is a successful effort to put together the views explaining contemporary growth of international trade and investment. Rugman argues that the deepening structural integration of the world economy and the burgeoning of alliance capitalism are widening the geographical scope for creating or augmenting firm-specific competencies and learning experiences. Any attempt to identify the geographical sources of such advantages must embrace the diamonds of other countries, particularly those with which the home-country firms have the most dealings by way of trade, FDI and non-equity co-operative ventures.