From the January 1, 2016 the DCFTA has been come into power and this also can make the positive influence on economic situation in Ukraine. The main DCFTA goals are to boost trade in goods and services between the EU and Ukraine by gradually cutting tariffs and bringing Ukraine's rules in a line with the EU's in certain industrial sectors and agricultural products (Countries and regions, 2016).

Thus, the main purpose of DCFTA is creating the free trade zone between Ukraine and EU. The main aspects of DCFTA are following:

- The import duties for mostly products which most imported to the markets of each other will be canceled in both sides.

- The rules of origin products, which are one of the elements of the application of trade preferences, will be created.

- Ukraine should create and adopt the technical regulations, procedures, sanitary and phytosanitary measures and food safety in accordance with European. As consequence it will be allowed that Ukrainian industrial goods, agricultural and food products will not require the additional certification in the EU.

- All sides will have to create the particularly favorable conditions to access to their services markets.

- The main EU rules of government tender must be implemented. As results Ukraine has opportunity to take part in market of EU tenders.

- The customs procedures will be simplified.

- Ukraine should strengthen the protection of property rights (Governmental Portal, 2015).

During the last two years Ukrainian economy is operating in conditions of macroeconomic fluctuations the last could be measured by the following indicators as real GDP growth, changes in private consumption, public debt developments, consumer inflation, hryvnia exchange rate per USD, current account balance, foreign direct investment.

Thus, during the third quarter of 2015, the rate of decline of GDP was up to 7% yoy, and according to Sigma Bleyzer prediction the GDP may fall by 11.5% in 2015 and may grow by 2% in 2016. Also, it seen from the table that the majority of macroeconomic indicators were deteriorating in Ukraine within in the 2015. However, the agricultural production index rose by 0.5% yoy, compared to a 4.2% yoy decline in September 2015.

Ukraine is moving in the direction of approximation to EU legislation in many areas like; competition, government procurement, and protection of intellectual property rights. It is expected that DCFTA would contribute to the modernisation and diversification of the Ukrainian economy and will create additional incentives for reform, notably in the fight against corruption. In fact DCFTA could be treated as opportunity for Ukraine to improve its business climate and to attract foreign investment, helping Ukraine to further integrate with the world economy (Trade part, 2016). However, in the conditions of macroeconomic fluctuations it is very hard to receive strong benefits due to the DCFTA implementation.

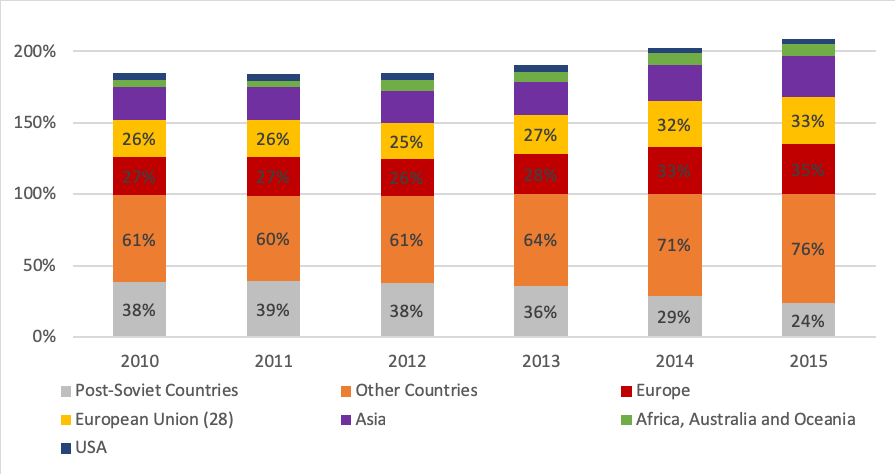

According to the official statistics, the export of products and services to Post-Soviet countries has decreased by 40% in 2015 from 2014. Moreover, the share of export goods and services to Post-Soviet countries has been decreasing from the 2013 year. Thus, in comparison to 2013 there was decreasing in 2014 about 7%, in 2015 it was 12%. From the other side the share of the export to EU has been increasing from year to year. Thus, compare to 2013 the increasing in 2014 was 5%, in 2015 was 7% (figure 1).

Figure 1 Share of export by country in total Ukranian export products and servicies (2010-2015), %

Source:Data from database: State Statistics Service of Ukraine

The results of import dynamics to Ukraine has showed that the import from Post-Soviet countries is also slowly decreasing and import from EU is increasing from year to year. The main Ukrainian exports are raw materials (iron, steel, mining products, agricultural products), chemical products and machinery. Unfortunately, the export of products has decreased in 2015 by 7,0%. Most of export reductions were brought by falling of mineral fuels, lubricants and related materials selling. It is necessary to underline that the import of food, drinks, tobacco and live animals has increased. In additional to that the import of animal, vegetable oils, fats and waxes had already increased in 2015 by 3.9% in comparison to 2014 (table 2). All of these testify that the entrepreneurs in the agriculture sector can receive the most positive effect of DCFTA implementation. Thus, the export of the cereal crops has increased by 3 % in 2015 comparing to 2013. Also, the export of electrical machinery and equipment also has increased by 3% in 2015 comparing to 2013.

The main Ukrainian export to EU does include small portion of machinery and transport equipment, chemicals, and manufactured goods (Countries and regions, 2016). On the contrary, the share of Manufactured goods classified chiefly by material was 27% which was higher by 8% in comparison to 2014.

The import volume of Miscellaneous manufactured articles didn’t change – 22%. Increasing per 1% was by the following indicators: Chemicals and related prod, n.e.s, Crude materials, inedible, except fuels, Miscellaneous manufactured articles.

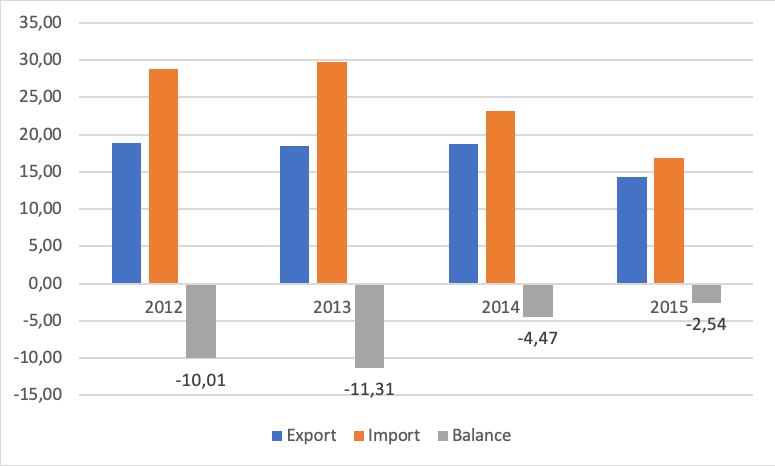

The trading balance between Ukraine and EU is presented on the figure 3. According to the results after the starting the EU integration process the difference of the trading balance has started to change to the positive side. If in 2012 the balance was €-10.01 billion, in 2013 was €-11.31 billion, so in 2014 was €-4.7 billion and in €-2.54 billion.

Of course, it is connected to the decreasing of trading volume with EU, but from the other side the reduction of trading balance is consequences of opening boundaries to EU market for Ukrainian entrepreneurs.

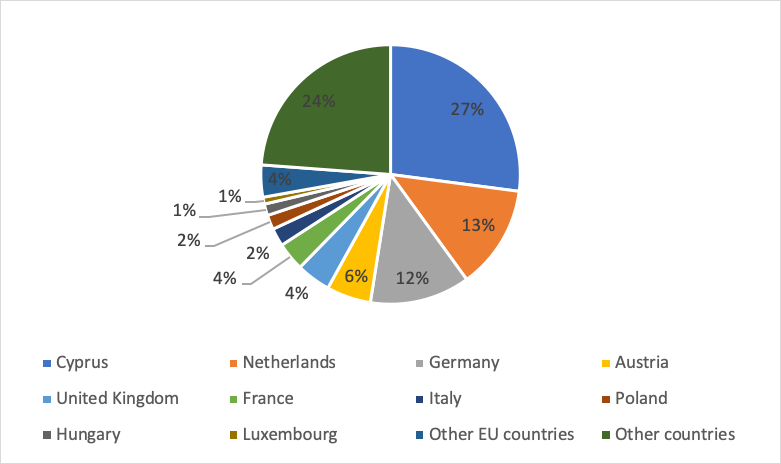

The EU is a large investor in Ukraine. EU investors held investments worth around €30 bn in Ukraine in 2015. It was 76.2% of total sum of investments in Ukraine. In 2015 through EU the largest investors were Cyprus (27%), the Netherlands (13%) and Germany (12%). Moreover, in 2015 year the structure of the main investors didn’t change.

Figure 2 Dynamic in trade of goods between Ukraine and EU (2012-2015), bln euro

Source:Data from database: State Statistics Service of Ukraine

Figure 3 The foreign investors’ structure in Ukraine, 2017

Source:Data from database: State Statistics Service of Ukraine

Unfortunately, the process of EU integration and market reorientation were not properly forecasted. In this case, Ukrainian entrepreneurs could not feel fast benefits from integration process and DCFTA implementation. In general, Ukraine has already harmonised a lot of its norms and standards in industrial and agricultural products and the last should stimulate better integration with the EU market. In addition, Ukraine has already aligned a lot of its legislation to the EU's in trade-related areas such as:

- competition;

- public procurement;

- customs and trade facilitation;

- protection of intellectual property rights;

- trade-related energy aspects, including investment, transit and transport (Countries and regions, 2016).

According to the Summary Report of EU Support to the Private Sector in the context of Association Agreements/DCFTAs the main constraints which limited the development of Ukrainian entrepreneur’ sector is as following:

- Cost of finance.

- Availability of finance (willingness to lend).

- Political instability.

- Corruption

- Tax rates (EU Support to the Private, 2015).

The DCFTA implementation is called not to remove the market boundaries only, however the new mutual opportunities for EU and Ukraine should arise. As a result, Ukrainian Small and Medium sized Enterprises (SMEs) have got opportunity to receive funding from the EU's SME Flagship Initiative. The mainobjectives of this Initiative for Ukraineare:

- Help SMEs to seize new trade opportunities with the EU and within the region which have been opened up thanks to the DCFTA;

- Improve access to finance for SMEs to make the necessary investments to comply with the provisions of the DCFTA;

- Allow SMEs to take advantage of the increased inflow of foreign direct investment triggered by the DCFTA;

- Enable SMEs to comply with new sanitary, phytosanitary, technical and quality standards, as well as with environmental protection measures, thereby benefiting local customers and boosting exports to the EU and beyond.

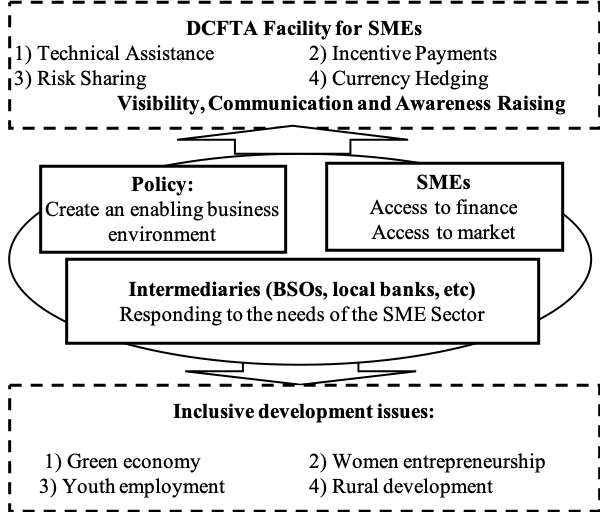

The working mechanism of EU's SME Flagship Initiative combine and harmonize three main directions (policy, intermediaries and SMEs) with purpose to solve the inclusive development issues and to provide Visibility, Communication and Awareness Raising are presented at the figure 4.

Figure 4 The structure of intervention the EU's SME Flagship Initiative

Source:Created by authors on the Eastern partnership, 2015

According to the main policy of EU's SME Flagship Initiative, the DCFTA Facility for SMEs will receive approximately € 200 millions of grants from the EU budget, which are expected to unlock at least € 2 billion of new investments by SMEs in the three countries (Ukraine, Moldova and Georgia), largely coming from new EFI loans supported by the Facility.

Such investments will transform the business fundamentals. The local banking sector, business services to SMEs, trade and quality infrastructure, and the overall business climate will highly benefit from the Facility, creating hereby a virtuous cycle of growth and contributing to significant job creation (Eastern partnership, 2015).

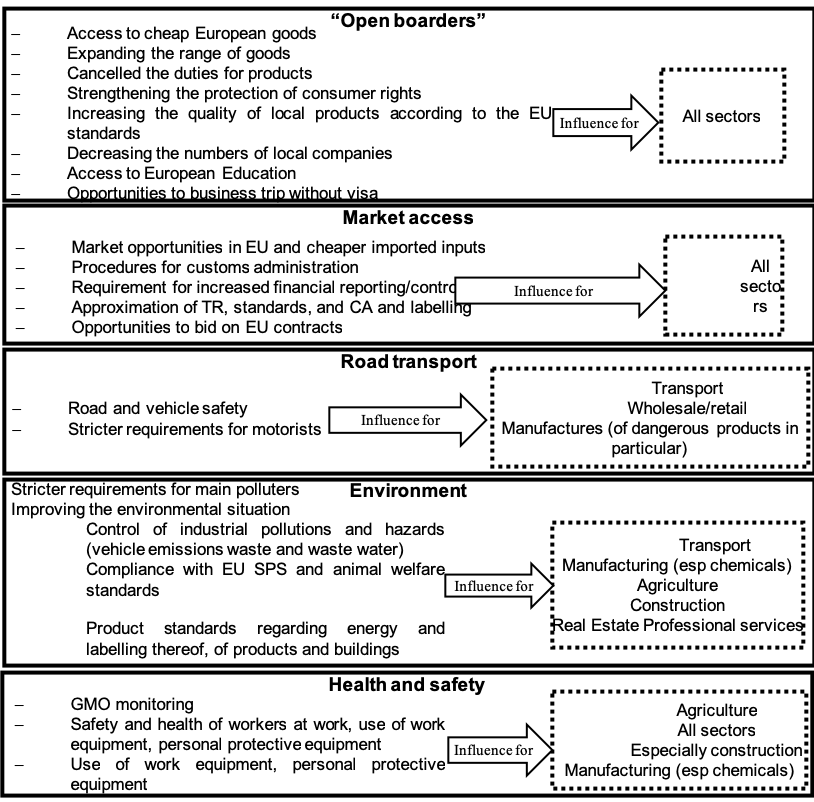

Thus, first of all the import and export duties and tariff quotas will be eliminated. From one side it means new opportunities for exports into the EU and enlarging the quality and range of products. At the same time, it is the threats for local entrepreneurs which are not ready to work in international market according to the EU standards. As a consequence, it will be stimulating the local entrepreneurs to become competitive or loose the business. The following consequence is reducing tariff and, most importantly, non-tariff barriers to entering the EU market, which is currently the largest regional market and one of the two largest trade partners of Ukraine (EU-Ukraine, 2015). The improving and adaptation of legislation according to EU standards allow creating the favourable domestic business climate. The increasing of compliance costs with “social” standards stipulates improvement of labour conditions, increases salary to enlarge the work opportunities in EU. In addition, DCFTA is considered to be one of engines to stimulate sustainable development. That is why the requirements for main polluters will be stretchered (Kubatko O., Pimonenko T., 2015).

Figure 5 Systematizing the perspectives of DCFTA implementation for Ukrainian entrepreneur’s sector

Source: Compiled by the authors on the basis of the literature sources (Eastern partnership,2015), (Kubatko O., Pimonenko T., 2015)

Taking into account the current situation in Ukraine the perspectives of DCFTA implementation for Ukrainian entrepreneur’s sector can be improved by the following activities:

- to decrease the gaps in the Ukrainian legislation in comparison to EU. At the same time Ukrainian entrepreneurs should quickly adopt to new conditions. That is why they should continuously improve their knowledge;

- to create the national mechanisms for cooperation and participation in international markets. Ukrainian entrepreneurs must participate and be represented at international level.

- to create and implement new procedures and systems needed for customs officers in issuing certificates of origin and for MEDT on administration of TRQs. And also, Ukrainian entrepreneurs should learn how to work in such requirements;

- to create new independent non-governmental body responsible for standardization and transfer of the functions of the Secretariat of 30 technical committees on standardization. In this direction, Ukrainian entrepreneurs must prepare for the certification process;

- to adopt and harmonize the customs administration procedures including risk assessment, post clearance controls and company audit methods according to the EU requirements.

- to learn how to write grants and project to receive the financing support from EU sources;

- to create administrative system for air and water quality monitoring. In such directions Ukrainian entrepreneurs should change their thinking from mainly economics results, to the environmental problems and future generation challenges. They must be ready to spend money for innovative green technologies.